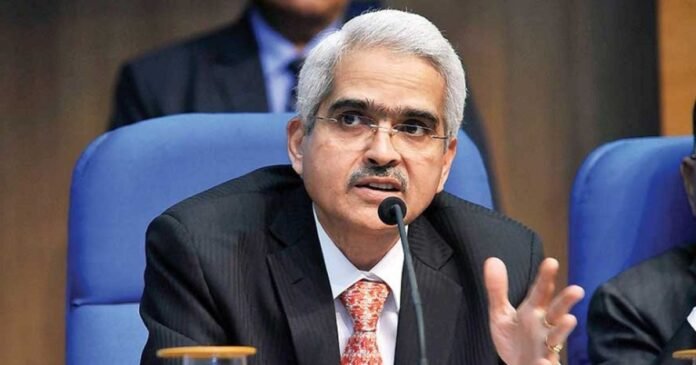

The recent Monetary Policy Statement by Reserve Bank of India Governor Shaktikanta Das highlighted ten key points, summarizing the key aspects of the review announced on December 8. Here’s a concise recap of RBI Monetary Policy Highlights:

1. The years 2020 to 2023 are marked by significant volatility.

2. India’s GDP growth remains robust, with a projected 7% growth for the current year.

3. Inflation has seen improvement, indicated by the steady decline in core inflation. However, caution is advised, and the next point emphasizes the need for patience.

4. Inflation management is expected to face challenges due to uncertain food prices. Consumer Price Inflation (CPI) data for November is anticipated to be high.

5. The Monetary Policy Committee (MPC) remains vigilant, ready to address any signs of deviation from the ongoing disinflation process. Appropriate actions will be taken based on the evolving situation to achieve the 4% inflation target.

6. Liquidity will be actively managed in line with monetary policy.

7. The financial sector’s balance sheet is robust, with proactive monitoring and addressing of sectoral and institution-specific stress. Prudence is the guiding philosophy, avoiding waiting for issues to escalate.

8. The Current Account Deficit (CAD) is expected to be modest and easily financed.

9. Foreign exchange reserves, standing at US $640 billion, offer a strong buffer against global spillovers.

10. The stability of the Indian rupee reflects the improving macroeconomic fundamentals and resilience of the Indian economy in the face of global challenges.